Does Applying For Apple Credit Card Hurt Credit

A CoOwner must be in the same Family Sharing group and if they dont already have their own Apple Card theyll need to apply. Applying for a credit card can hurt your credit score in the short term which is why you should avoid making new applications in the six to 12 months before applying for a major loan like a mortgage or auto loan.

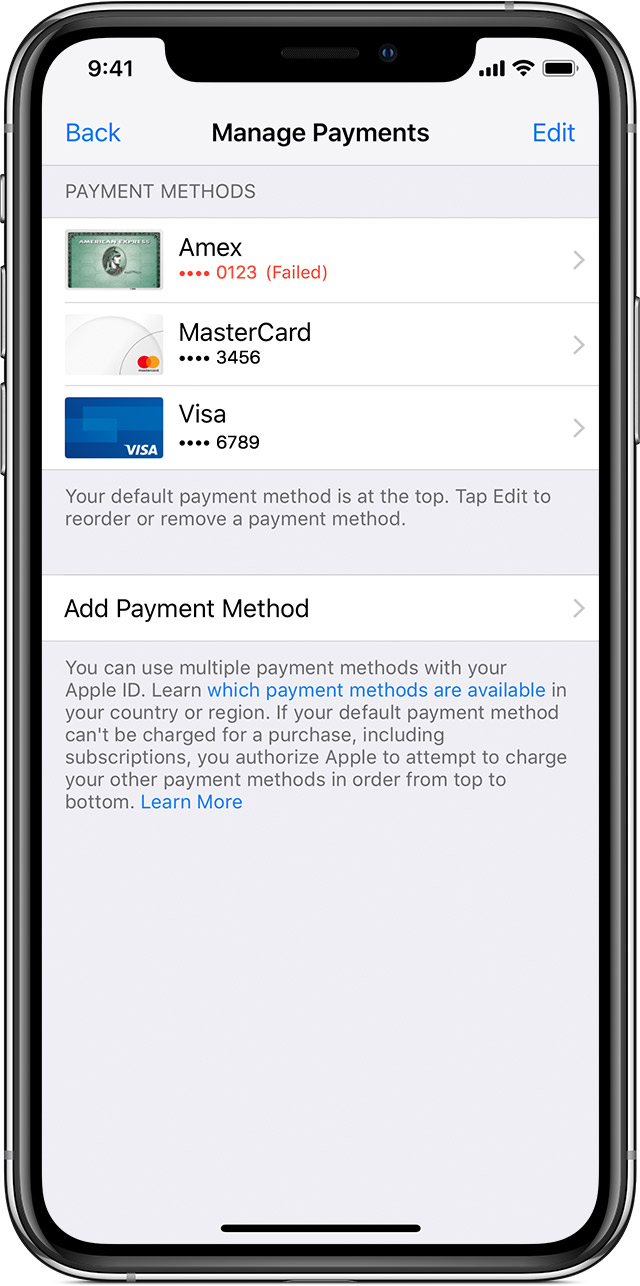

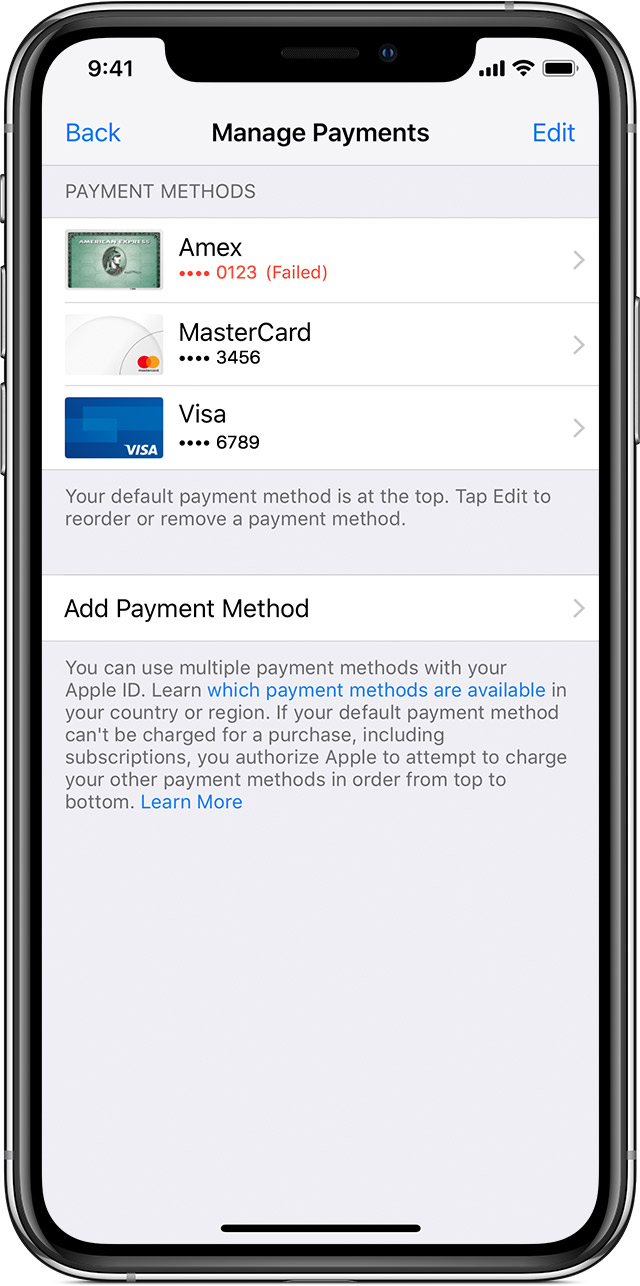

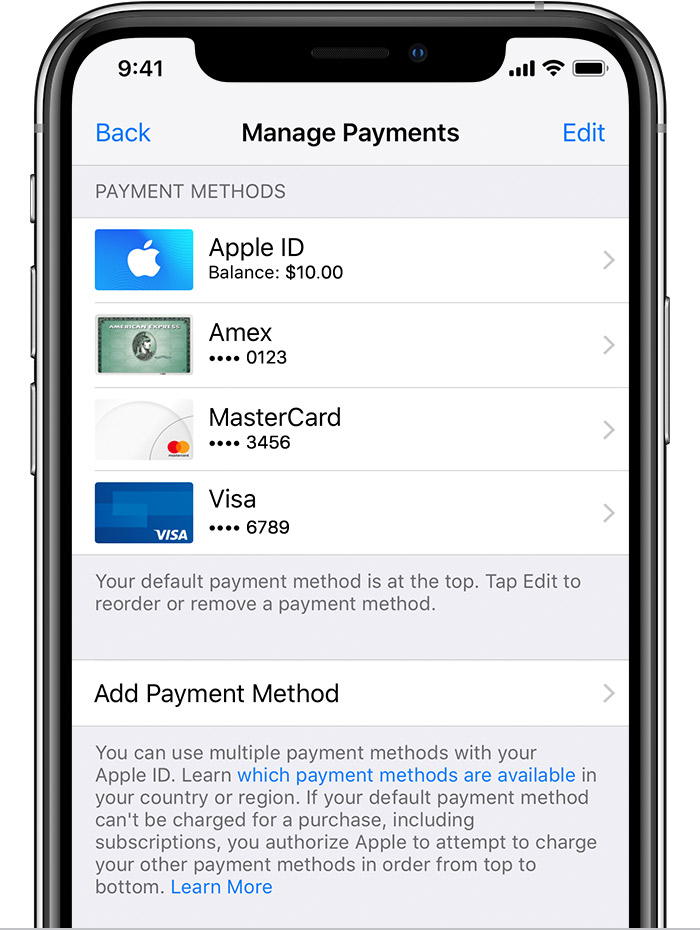

If Your Payment Method Is Declined In The App Store Or Itunes Store Apple Support Qa

When you apply for a credit card the company will check your credit report as part of the approval process.

Does applying for apple credit card hurt credit. CoOwners build credit as equals 10 can manage the account together and can set limits for Participants. We did not find results for. Youre using 10 of your combined credit limit.

Whether your Apple Card application was rejected due to a low credit score or income negative credit report marks or heavy debt you can take steps to improve your chances when you apply again. One of the most common things people believe when they start applying for new credit cards is that those actions will negatively and permanently impact their credit scores. Apple Card Family CoOwners share their credit lines for a combined limit.

Each time a company pulls your credit rating to approve an application it impacts your credit rating. Check spelling or type a new query. But multiple applications for cards in a.

A hard inquiry will appear on your report showing that the company requested it. Certainly yes a card can help you build credit says John Ulzheimer who has worked at credit bureau Equifax and credit analytics company FICO. Credit card providers get weary when they see a bunch of credit inquiries too close to each other.

When you apply for new credit the lender will typically perform a credit check. This guide can help you get a better sense of the potential implications of a new credit card application on your score. Does Applying for Credit Card Hurt Your Credit Score As A Consumer.

Also try to avoid applying for cards close to when you apply for Apple Card. Take a look at your credit factors and focus on the ones that will have the biggest impact for you. If you accept your offer a hard inquiry is made.

Does applying for an Apple Card impact your credit score. Plus applying for the Apple Card more than once wont hurt your credit score. Maybe you would like to learn more about one of these.

Just a single application may shave a few points off your score. We did not find results for. If you canceled the card with the 10000 limit you would cut your overall credit limit in half which would double the percent of available credit.

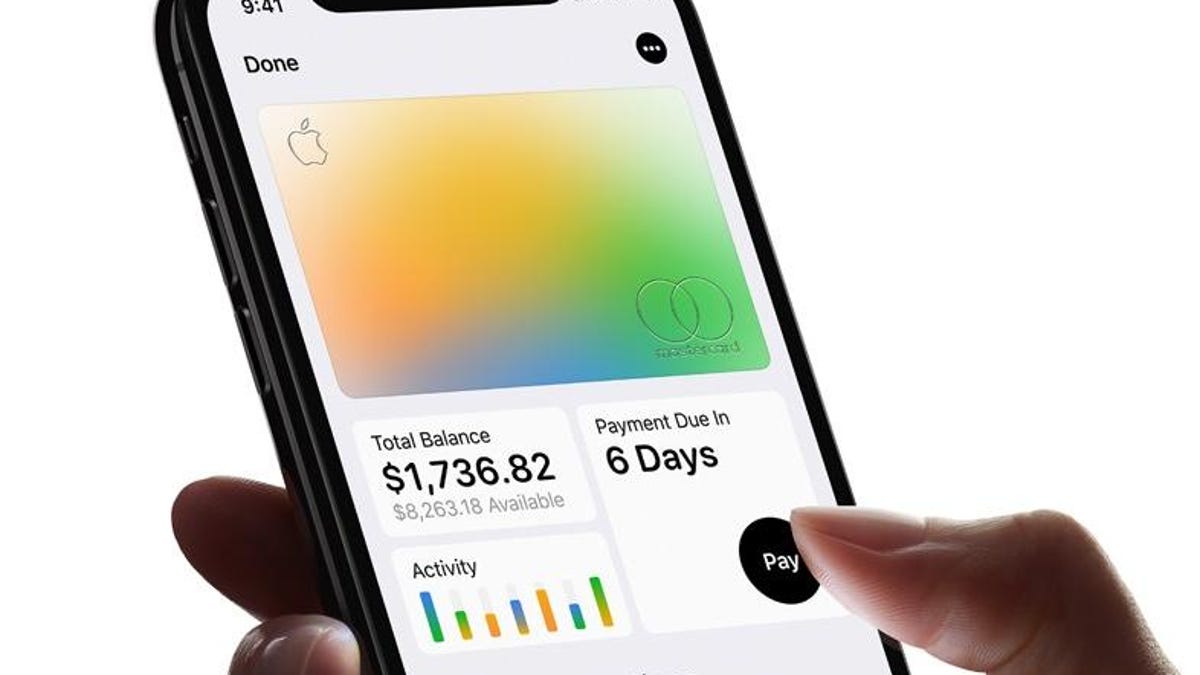

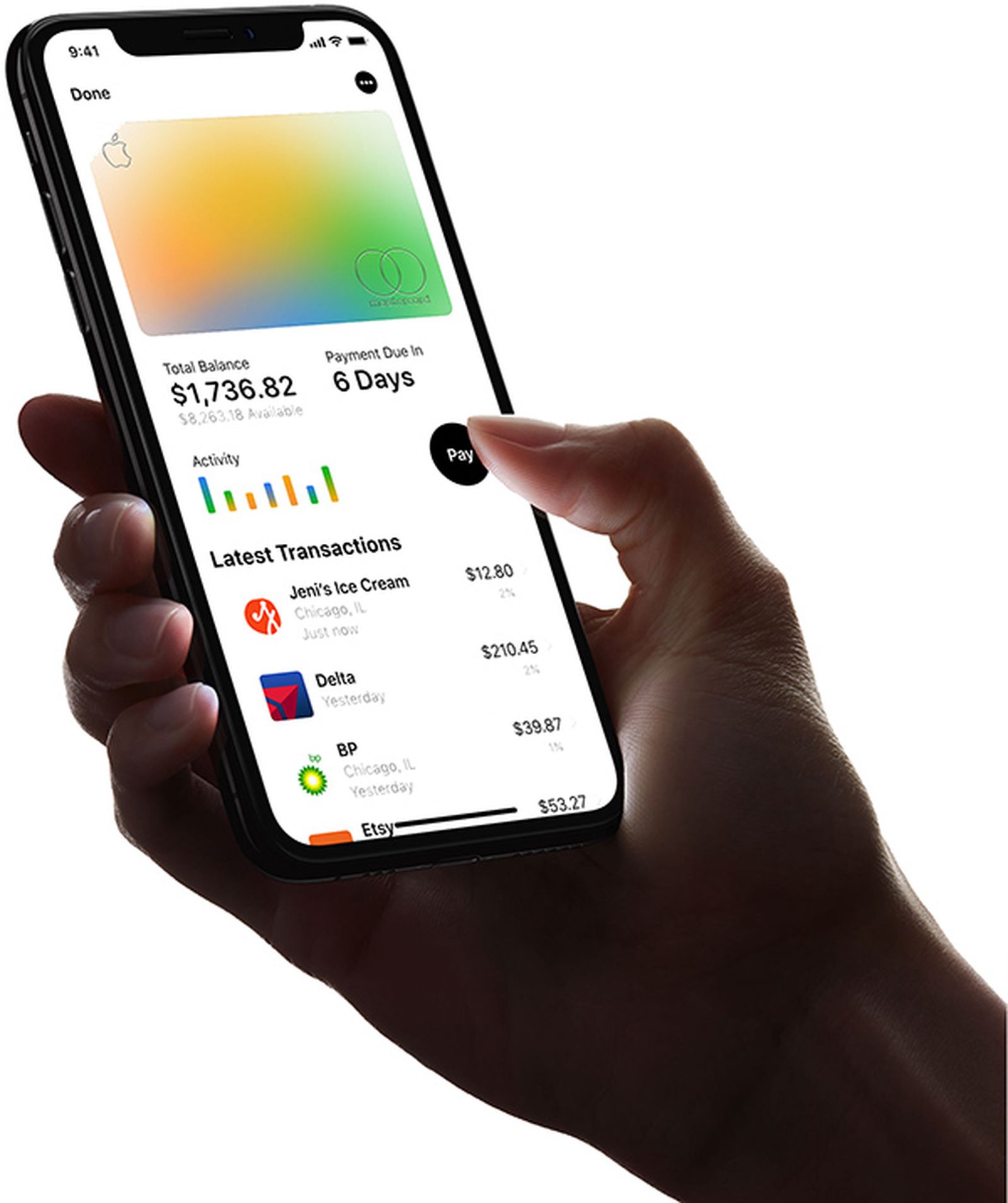

Security and privacy The physical version of the Apple Card doesnt have a credit card number providing you a little extra security in case your card is stolen. Does Applying For Apple Card Hurt Credit Does Getting Denied For A Credit Card Hurt Your Score. How Applying for a Credit Card May Affect Your Credit.

Check spelling or type a new query. Applying for a new credit card will result in a hard inquiry in your credit file which could lower your score by a few points. If you apply for Apple Card and your application is approved theres no impact to your credit score until you accept your offer.

This may impact your credit score. You may see a slight drop in scores at first but a single inquiry for a credit card is not likely to. If the card issuer does.

Credit card providers take a peek into your credit rating when evaluating. Maybe you would like to learn more about one of these. Does applying for apple card hurt credit.

The card also includes other Apple Pay security features such as Face ID Touch ID and unique transaction codes making it a little more robust than your average credit card. Generally credit card applications trigger hard inquiries on your credit report which unlike soft inquiries can affect your credit score. If your application is declined or you reject your offer your credit score isnt impacted by the soft inquiry associated with your application.

This often results in a hard inquiry into your credit history which means the lender pulls your credit report from. Applying for credit cards can damage your credit scores. Apple Card reports to all of the three major credit bureaus.

While a hard inquiry will remain on your report for two years it will only affect your credit score for a few months. Your credit score is a three-digit number utilized by financial institutions and loan providers when deciding whether to authorize your applications. First Apple says that your credit score wont be affected if.

That said some scores go unaffected.

Now Use Your Coinbase Card With Apple Pay And Google Pay By Coinbase The Coinbase Blog

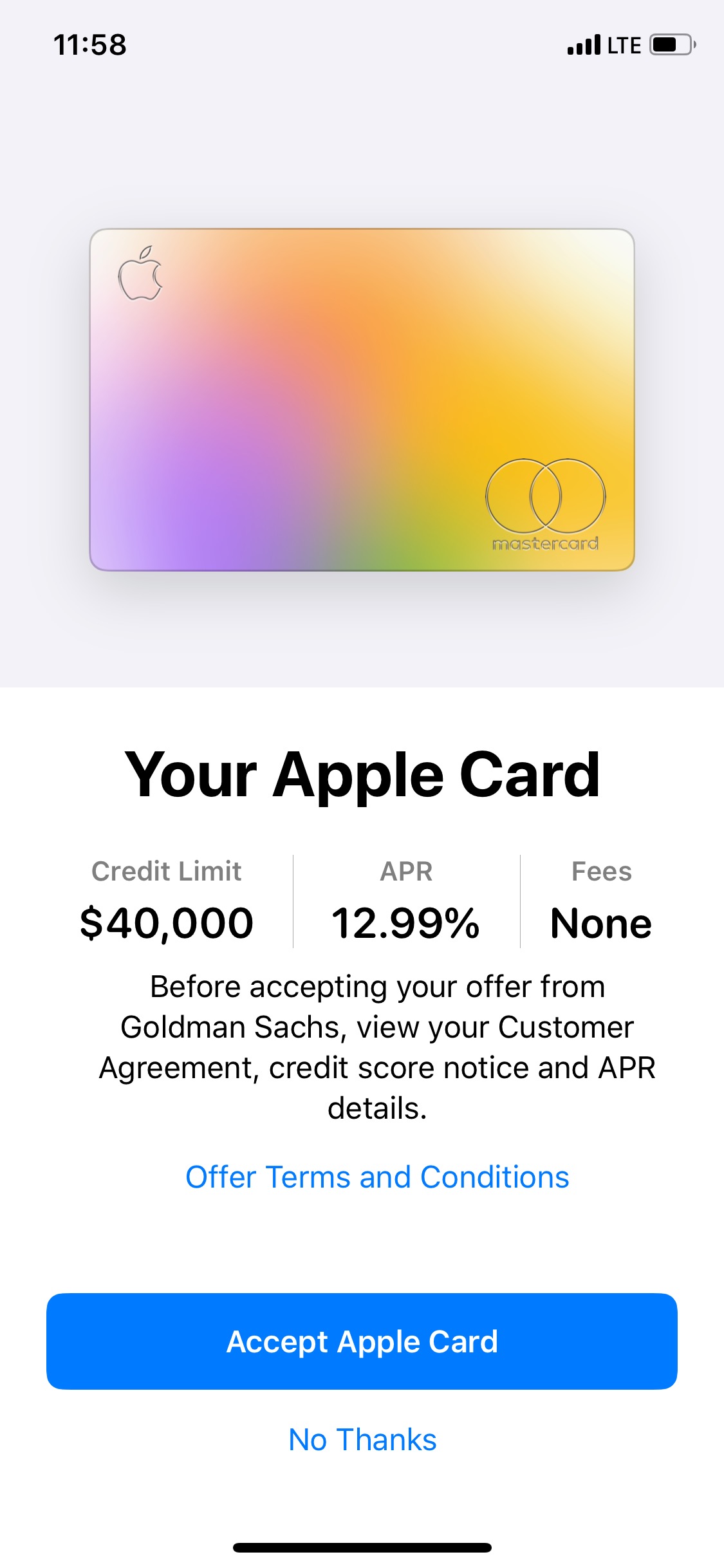

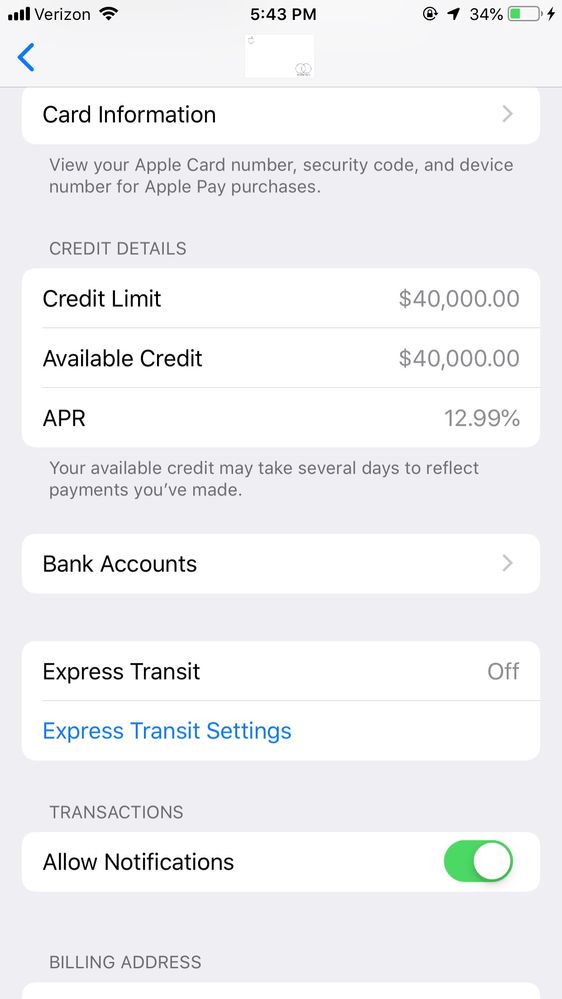

Apple Card Approval 40k Limit At 12 99 Apr Myfico Forums 5709263

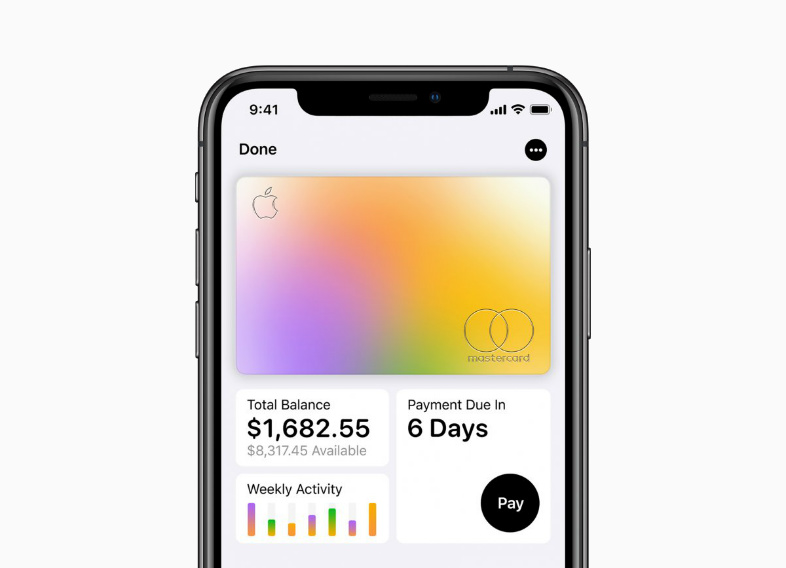

Apple Card Guide Features And Tips For Maximizing Creditcards Com

Apple Card S Fine Print 7 Things You Should Know About Apple S New Iphone Credit Card Cnet

Apple Card Reviews 100 Apple Credit Card Ratings

Pin On Emv Nfc Secure Credit Card Payments

Apple Card All The Details On Apple S Credit Card Macrumors

Apple Card Vs Chase Sapphire Which Card Is Right For You Cnet

Apple Card For Iphone Available Now Sign Up Credit Rewards Cnet

Does Paying Off Credit Cards Hurt Your Credit Credit Cards Stolen Best Cre Credit Card Check Out H Credit Card Design Credit Card Icon Credit Card Sign

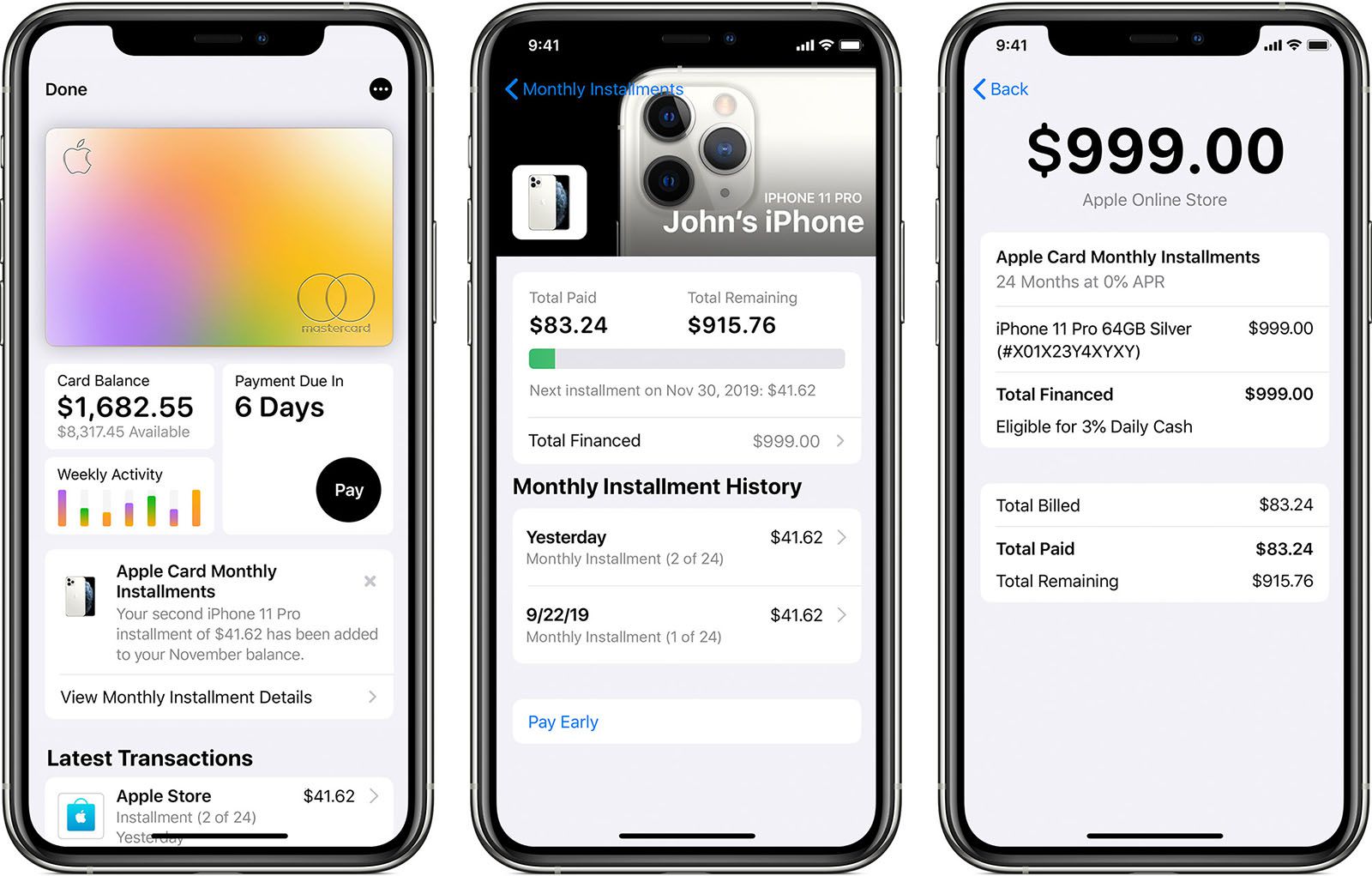

Apple Card Monthly Installments How The Interest Free Iphone Financing Plan Works Macrumors

Apple Card Approval 40k Limit At 12 99 Apr Myfico Forums 5709263

Apple Card Review 2021 Should You Apply Mybanktracker

/article-new/2019/03/applecardtitanium-800x580.jpg?lossy)

Apple Card All The Details On Apple S Credit Card Macrumors

The Apple Card Starts Rolling Out Today Credit Card Machine Credit Card Rewards Credit Cards

/article-new/2020/02/apple_card_ofx.jpg?lossy)

Apple Card All The Details On Apple S Credit Card Macrumors

Apple Card Full Review Is It Worth Signing Up 2021

Payment Methods That You Can Use With Your Apple Id Apple Support Au

The New Apple Card Won T Let You Switch From Iphone To Android Probably Ever Cnet

Post a Comment for "Does Applying For Apple Credit Card Hurt Credit"